Frequently Asked Questions

About Income Annuities

Description of Annuities Addressed in This FAQ

There are many types of annuities; however, the focus in this website and FAQ is on the Income Annuity that was first offered in the U.S. more than 100 years ago. It can be defined as a series of guaranteed payments made by a life insurance company, typically on a monthly basis, for the life of the annuitant. The payments may start within 13 months (Immediate Annuity) or start at a later date/age the annuity owner selects (Deferred Income Annuity or QLAC). The savings sources for Income Annuities are very broad (see below).

Within each type of Income Annuity, there are lots of options, including such choices as the form of the annuity payout and beneficiary protection, and hence the need for this FAQ. In addition, in each of the three “shortcuts” in this website there are calculation tools which can enable you to customize your own Income Annuity plan, as well as more background on each type of annuity. You can even have top annuity companies bid on the Income Annuity plan you design for yourself.

| Profile of Income Objectives |

Type of Income Annuity |

Shortcut Link |

|

Ages 60 to 85, Savings in IRA, 401(k), or Other Savings in Personally Held Accounts Want to: Increase and Secure |

Immediate Annuity |

|

Current Income |

Ages 50 to 75, Savings in Personally Held Accounts Want to: Increase and Secure |

Deferred Income Annuity (DIA) |

|

Future Income |

Ages 50 to 75, Savings in IRA,401(k), or Other Qualified Retirement Plans Want to: Defer Taxes and Secure |

QLAC |

|

QLAC Income |

If you'd like to learn more about the differences in these three types of annuities, request an appointment with a Go2Specialist.

Applicable to All Income Annuities

-

Does an Annuity MAKE SENSE for me?

-

Annuities are the only financial instruments you can purchase that guarantee income for your life, or for you and your spouse's life. Income payments deposited monthly into an account you designate can be considered “retirement paychecks”. There is a competitive Income Annuity marketplace where some of the highest rated life insurance companies vie for your business.

Annuities are suited for almost everyone - but not all types of annuities are suited for all. For someone having a life-expectancy that is below average (because of a health condition or family medical history), an annuity that pays out for life but without beneficiary protection could be an inappropriate purchase. For that individual or for individuals with a temporary but current need for secure income, a fixed period or temporary annuity might make sense. Among the many purposes served by an annuity, the primary ones are to: (1) increase current or future spendable income; (2) provide another source of lifetime Guaranteed Income beyond Social Security; (3) create regular monthly income to help meet basic expenses; (4) create late-in-retirement income to cover late-in-retirement expenses like medical and home heath care: and (5) free up savings to use for other purposes.

Any retirement investment has risks or tradeoffs, and so too does an Income Annuity. However, the risk is not related to stock market returns or interest rate swings; it's about the uncertainty of your life span. While a life only form of Income Annuity provides protection against living too long, you can add beneficiary protection to protect your beneficiaries in case of a shorter lifespan. Another risk is not all annuities provide for cost of living increases. You can either select an annuity with a lower starting payment that provides for increasing payments, or you can periodically purchase annuities to cover increased living costs.

There's very little for you to do in managing an annuity other than to include the taxable portion of the annuity payment in each year's tax return. Other than that, you will have a check deposited each month into the savings or checking account you designate.

-

Which FORM OF ANNUITY PAYOUT Should I Choose?

-

The form of annuity payout you choose depends on how much retirement income you want, whether it covers one or two lives, whether it's for life or for a temporary/fixed period (Current Income Annuities only), and the amount and type of beneficiary protection you want.

Some annuities provide beneficiary protection such that payments continue after the death of the annuitant. The protection can be expressed in terms of the total amount of payments paid out irrespective of the date of death of the annuitant. For example, under a Life with 100% Refund Annuity, beneficiary protection equals your premium deposit. It's essentially a “money back guarantee” in case of the early death of the annuitant.

Here is a list of your choices:

- Life Only Annuity: Payments guaranteed for the rest of your life

- Life Annuity with Certain Period: Payments guaranteed for the rest of your life, but not less than, say, 10 or 20 years (also called the refund period). This type of annuity payout is not available for a QLAC

- Life Annuity with 100% Refund: Payments for the rest of your life with a refund guarantee of the original premium less the total payments already received

- Fixed Period Annuity: Payments guaranteed for a “certain period” only of, say, 5, 10 or 20 years (not available for a QLAC or a Deferred Income Annuity)

Payments under Current Income Annuities must begin within 13 months of the premium payment, at a payment frequency you select. Payments under a QLAC must start by age 85: a Deferred Income Annuity may start after a deferral period beyond 13 months but typically before age 90

Other Forms of Income Annuity Payouts

Joint and Survivor Annuity.

This type of annuity provides regular income payments to you, and if the survivor you name (typically a spouse) outlives you, payments continue for his/her lifetime. The income to the surviving spouse can continue at the same level, or at time of purchase, you can elect (Current Income Annuity only) to have the survivor receive a lower amount reflecting the likelihood of lower expenses for that survivor. Selecting lower payments to the survivor increases the payments made while both are alive. This type annuity can also be purchased with beneficiary protection.

Annuity with Increasing Payments.

With this form of annuity, each year the annuity payments you receive increase (a) by the cost of living, usually subject to a maximum, or (b) by a specified percentage you elect at the time of purchase. For the same premium and annuity type, this annuity starts with lower payments, and it will take a number of years for these increasing payments to exceed the level payments of an equivalent annuity without such increases. Also, you could consider purchasing a series of annuities with level payments, by purchasing enough income each time to keep pace with your own cost of living.

-

How Does HEALTH Impact the Decision to Purchase?

-

While insurance companies may have different longevity experience within their pool of annuitants, they all make assumptions that the individuals electing to purchase an annuity are in good health. Thus, if you're in poor health or believe you have a shorter life expectancy because of, say, family history, a life only annuity may be the wrong purchase for you. If however, you like the peace of mind of Guaranteed Income, you can elect a Fixed Period Annuity for 5, 10 or 20 years (Current Income Annuity only). For similar reasons, if considering QLAC or a Deferred Income Annuity, you should consider electing the return of premium option which returns the premium in case of death before the Income Start Age.

There are also a number of companies that offer Current Income Annuities with higher payments if the annuitant is unhealthy. This may require some form of medical exam. If you and your spouse are considering a Joint and Survivor Annuity and one of you is in poor health, you might consider combining a life annuity on the healthy spouse and a Fixed Period Annuity on the one in poor health.

Request an appointment with a Go2Income Specialist for our suggestions when considering these issues.

-

How Do I SELECT an Insurance Company?

-

There is a competitive market for annuities with over 200 companies offering them to the public. For the same type of annuity there might be a difference in purchase rates of as much as 5% to 10%. Thus you want to make the right choice. Importantly, insurance company competitiveness may fluctuate based on company objectives and market conditions. Thus you want to know the then current rates whenever you're considering a new purchase. Because, there is little difference in product features, you generally want to select the company with the best rates.

However, you do want to pay attention to insurance company ratings, which are assigned to insurance companies by a recognized rating agency such as Standard & Poor's. Insurance companies have some of the highest ratings in financial services.

Besides the security from the life insurance company, and depending upon the state in which the contract was issued (usually your state of residence) each state has an insurance guarantee fund that guarantees annuities for amounts between $100,000 and $500,000.

-

HOW MUCH of MY Retirement Savings Should Go to Buying an Annuity?

-

That depends on how much Guaranteed Income you want to receive, when you want to receive it, and for how long. It also depends on your other sources of Guaranteed Income, such as Social Security and any pension. Again, consider the “no worry age” concept that can help in answering both when and how much.

Also, the allocation of a portion of your retirement savings to annuities should be considered as both a risk management and investment allocation decision. Because of the guaranteed income aspects of the annuity, you should consider an annuity as a part of your allocation to fixed income investments.

Request an appointment with a Go2Income Specialist for our suggestions when considering these issues.

-

Can I Use 401(k) Distributions to Purchase an Annuity?

-

Many 401(k) plans offer a series of annuity options but offer little help in assisting you make the right decision. They do require that if you are electing an annuity option you elect out of a special joint and survivor annuity. Under this annuity, the annuity payments only reduce on the death of you the annuitant, not on the death of the survivor annuitant.

When considering an annuity option offered through your employer, you should also shop the commercial annuity market. There may be better rates and/or different options to choose from.

You might also consider QLAC which, in addition to IRAs, has been designed for 401(k) savings (if available under the Plan) as well. QLAC Shortcut

-

What Does BENEFICIARY PROTECTION Cost?

-

Annuities come in different forms so you can pick and choose the features you want. For example, if you want the maximum amount of lifetime Guaranteed Income, then you'd purchase a life only form of Annuity and your entire premium is going toward protecting your longevity.

In finding premiums to fund your annuity you should generally look for assets where you don't have to realize a taxable gain in order to purchase. Generally that excludes assets with a capital gain, such as a portfolio of stocks or mutual funds.

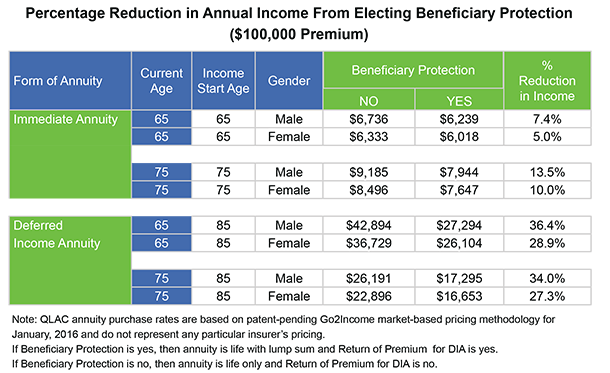

If your concern is for your beneficiaries in the event of death, then you would want to consider adding beneficiary protection and the choice of lower income for the same premium, or paying a higher premium for the same income amount and still get beneficiary protection. Set out in the table are examples of income with and without Beneficiary Protection.

Applicable to Immediate Annuities

-

WHEN Should I Purchase an Immediate Annuity?

-

The age or ages when you purchase an Immediate Annuity depends on your plan for retirement income. If you don't have one, it's important that you put one in place. As a generalization, these annuities make more sense as you approach the “normal” retirement age of, say, 65, although the typical age range is 60 to 75. Points to consider for purchases outside this range are:

- Purchases at ages under 60: Younger individuals might purchase small amounts of annuity income and gradually convert retirement savings into Guaranteed Income.

- Purchases at ages over 75: Older individuals without health issues might consider an Immediate Annuity, provided they elect beneficiary protection. In fact, some companies won't offer these annuities to older individuals without such protection.

One approach to retirement income planning is to have lifetime income from guaranteed sources, such as Social Security, any pension benefits, and an annuity, to cover basic or essential expenses by the time he/she achieves a “no-worry age” of choice, typically between 75 and 85.

Not only is the age at purchase important, but also is the timing of purchases, particularly in relation to then current market conditions. Here are some points to consider:

- Should you wait for interest rates to increase before purchasing an annuity?

- Should you purchase annuities at different times or “ladder” into your Guaranteed Income?

Request an appointment with a Go2Income Specialist for our suggestions when considering these issues.

-

Which SAVINGS Should I Use to Purchase an Immediate Annuity?

-

Typically, the premium you pay for an annuity comes from your accumulated retirement savings, any deferred annuities you may own, and/or a lump sum received from a life event. Those life events might include an inheritance, proceeds from the sale of a home or business, or proceeds (including cash values) from a life insurance policy. Premiums may also come from interest-bearing accounts, particularly if the interest earned is part of the retirement income you are spending. They can also come from retirement plans, like a 401(k) or 403(b), although these plans may offer their own set of annuity options. See Investor Stories for some real life situations.

In finding premiums to fund your annuity you should generally look for assets where you don't have to realize a taxable gain in order to make the purchase. Generally that excludes assets with a capital gain, such as a portfolio of stocks or mutual funds.

However, there are several situations in which the gain is not taxed:

- Deferred Annuity (fixed or variable) - These contracts, even though they may have appreciated since purchase, may be exchanged income tax-free to another annuity under Section 1035 of the Internal Revenue Code. Eventually taxes will be paid but they will be spread over the annuity payments you receive when you may be in a lower tax bracket.

- Proceeds from downsizing your home - You may have appreciated value in your home, and up to $500,000 of any gain may be excluded from taxation.

- Inheritance - While you may be receiving appreciated assets, they receive a step-up in basis at death so that unrealized capital appreciation is not taxed.

We suggest you contact your tax advisor about which assets to deploy.

Request an appointment with a Go2Income Specialist for our suggestions when considering these issues.

-

Can I ACCESS an Annuity's Values?

-

Annuities with a refund or certain period have what is known as a commuted value. For most of these contracts you can withdraw a portion of the commuted value in exchange for a reduction in your payments during the refund or certain period. That withdrawal decision should not be made lightly.

However, as part of a broader financial plan, you might consider borrowing money and using a portion of your payments as a source of repayment. Of course, you should not borrow beyond the value of payments made during the refund or certain period.

Here is an example: An investor (male aged 70) purchases a Life with 100% Refund Annuity for a $100,000 premium. Based on December 2015 pricing, the annuity payment is $6,971 with an assurance that it will be paid for 14 Years. At current interest rates, that's worth approximately $70,000, which can be accessed through the contract's commuted value or through external financing. Both should be used sparingly.

-

How Are Annuities TAXED?

-

If the source of premiums for the annuity is from personal savings and not from a 401(k) or IRA, a portion of your annuity payments are free from tax. While the actual formula is quite complex, the principles are quite straightforward. If a portion of your premium comes from funds that have already been taxed - otherwise known as a cost basis - then that cost basis is recovered over the period of the payments.

To find out how much spendable after-tax income you will have, order a quote from your Current Income of Future Income shortcuts.

If that cost basis has not been recovered at the time of death, the unrecovered cost basis can be a deduction in the decedent's final tax return. If you make a withdrawal from your commuted value, then that amount may reflect the recovery of a cost basis.

-

How Do I Evaluate ALTERNATIVES to Annuities?

-

It's challenging, even for most financial advisors, to compare a product like life insurance, long term care insurance or an annuity, to an investment vehicle. Besides the obvious investment and tax differences, the most critical issue is that the “return” under insurance-issued policies depends on your lifespan and in some cases your health.

To help you compare an annuity with an alternative, we have determined the rate of return under the annuity depending on your “survival age”. Go to Rate of Return.

While there are many types of plans and schemes that offer streams of retirement income, you have to make any comparison by answering the following questions for the alternative:

- Is the income guaranteed?

- If so, what is the credit rating of the financial institution?

- If not, what parameters affect the outcome, such as market returns, interest rates, etc?

- Is the income payable for life?

- If not, what do you do if that account runs out?

- Is a portion of the income treated as a tax free recovery of cost basis?

Go to Do It Yourself for a specific example of when savings would run out if you tried to match the annuity on your own.

Applicable to Deferred Income Annuities

-

Why a Deferred Income Annuity (DIA)?

-

While many think of an Income Annuity as providing current safe and guaranteed income, why would an investor consider a DIA where income is paid at a future date? Why not simply invest in the market and purchase a Current Income Annuity at that future date. The answer is that both investing in the market and the DIA may both make sense, particularly when used in combination.

There are three basic reasons to consider a DIA:

- Wealth preservation: Purchase guaranteed lifetime income to cover late-in-retirement expenses and thereby preserve your savings/wealth for your kids/grandkids

- Stable and higher income: By securing this guaranteed income purchased at a discount for interest and survivorship, you're creating a predictable source of cash flow that improves your overall plan.

- Tax savings: By deferring income to late-in-retirement you're deferring taxes and possibly paying those taxes when you're in a lower tax bracket.

-

How does a DIA differ from QLAC?

-

A QLAC is a special form of DIA designed specifically for the IRA/401(k) market to meet IRS rules. Here are the differences. See QLAC Shortcut for details.

Amounts: With a QLAC, the purchase must be made by a tax free transfer of funds from an IRA and/or a qualified retirement plan such as a 401(k). The amount(s) transferred can be up to 25% of the total amounts in the IRA and/or 401(k), but not more than $135,000. The regulations provide for increases in these amounts as the IRS may specify.

With a DIA, the purchase is made with your personal savings. The maximum amount you can use to purchase a DIA is limited by the rules of the respective insurance company, and typically can be up to $1 million or more.

Insurers: More than a dozen highly rated life insurance companies currently offer DIA contracts; only about half that many offer QLAC.

Features: Here are two of the key differences:

Commutation: Subject to the provisions of the DIA policy, you can withdraw that contract's commuted value. This may be advantageous should you need to meet unanticipated long term care and/or medical expenses. That right is not available under a QLAC

Form of Annuity: With a DIA, you have several versions to choose from - Single Life, Joint Life, Life and Period Certain (benefits payable for life but not less than a specified number of years), and Refund (not less than the amount paid in). Under QLAC you are limited to Life Only and Life with Refund.

-

WHEN should you start income under a DIA?

-

When should you start income under a DIA?

If your need is for current income to meet current expenses or to generate a higher cash flow, then a Current Income Annuity makes sense. If, however, you'd like income deferred into the future or you'd like to create your own personalized Income Plan, select a Deferred Income Annuity. If your savings are in a Rollover IRA or qualified and you'd like to replace fluctuating Required Minimum Distributions (RMD) with future guaranteed income you should consider QLAC.

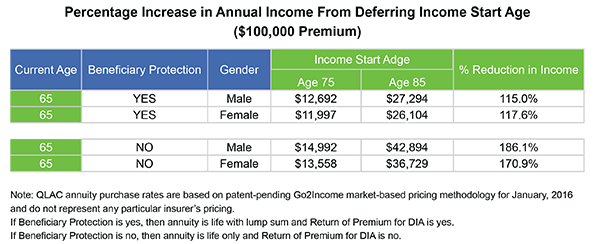

How much more income do I get for delaying the Income Start Age (ISA)?

The chart below shows the increase in income from delaying the DIA's Income Start Age (ISA). The compounding growth comes both from interest and longevity credits. Of course, the ISA should be selected with your personal objectives in mind.